Below, you’ll learn everything you should expect on capital gains taxes and how you can cut your tax bill. Tax-loss harvesting allows you to sell investments that are down and use those capital losses (meaning you sold for less than the purchase price) to offset the capital gains generated by other investments. Remaining losses can be used to offset income generally up to $3,000 and unused losses thereafter can be carried forward to future years. One major exception to a reduced long-term capital gains rate applies to collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine. Typically, any profits from the sale of these collectibles will be taxed at 28% regardless of how long you have held the item. Capital gains taxes are the taxes you pay on profits made from the sale of assets, such as stocks or real estate.

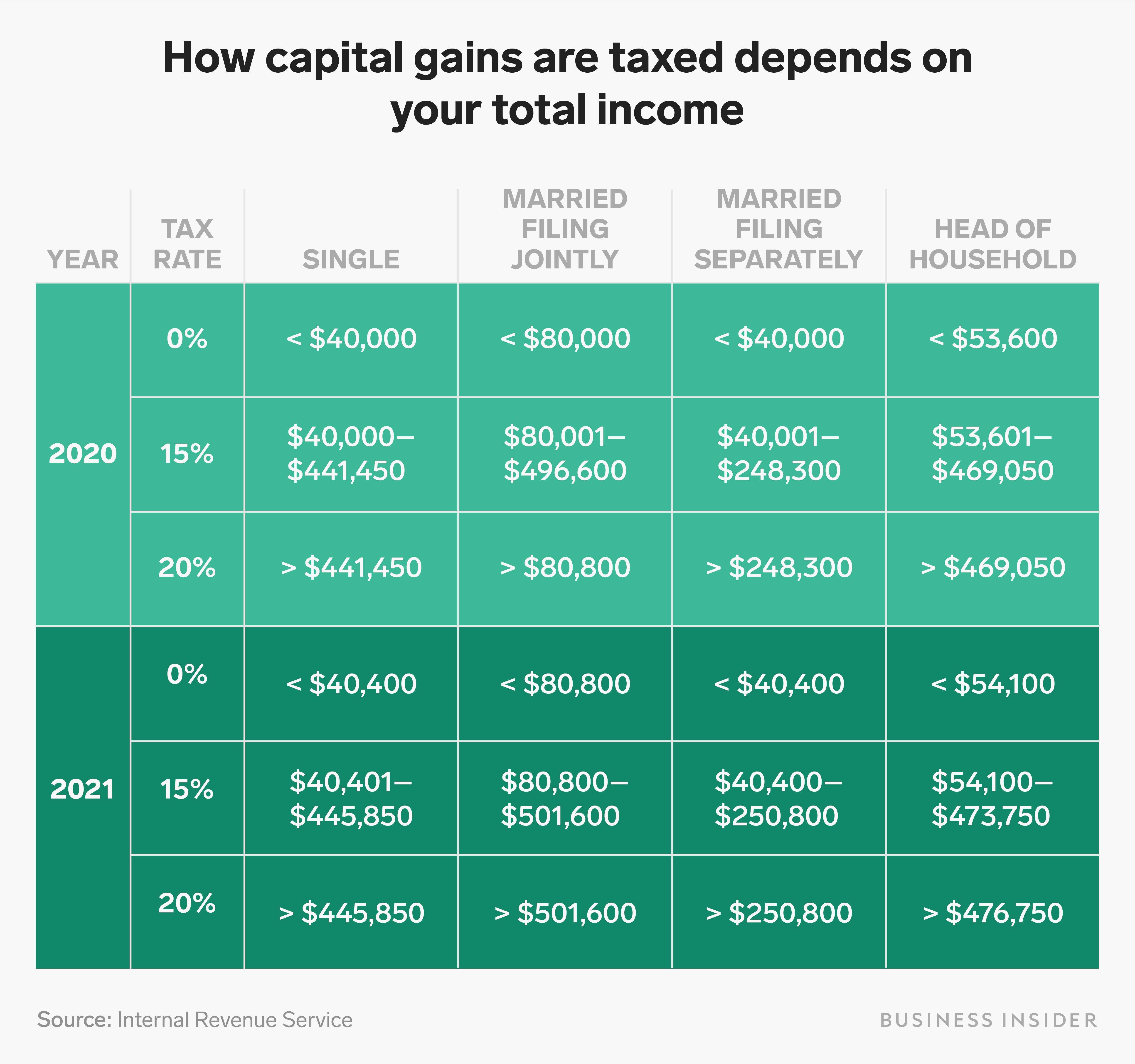

and 2024 capital gains tax rates

After applying the $250,000 exemption, this person must report a capital gain of $50,000, which is the amount subject to the capital gains tax. For tax purposes, your capital loss is treated differently than your capital gains. If you sell a capital asset at a loss, which typically means your selling price is less than its cost when you got the asset, you can claim a loss up to $3,000 ($1,500 if married separately) on your tax return.

Forms & Instructions

TurboTax Premium will guide you through your investment transactions, automatically import up to 10,000 stock and up to 20,000 crypto transactions at once and help figure out your gains vs. losses. TurboTax will help surface and guide customers to use any unrealized capital losses they may have from prior years, improving their tax outcome and lowering taxes owed. This will determine whether you have short-term or long-term capital gains. Now you know how to calculate Capital Gains Tax, you’re ready to delve deeper into the world of tax on investments in the UK!

What’s the difference between a short-term and long-term capital gain or loss?

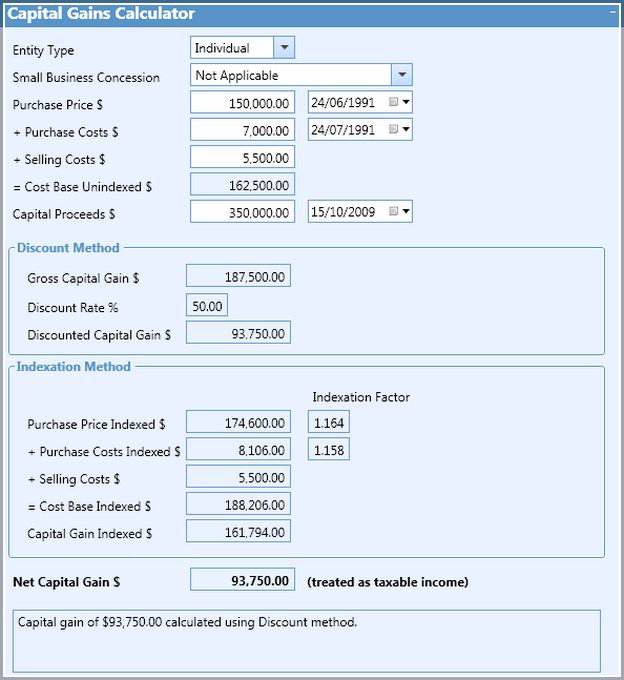

From stocks and bonds to real estate and cryptocurrencies, understanding how capital gains are taxed is essential for making informed investment decisions and optimizing tax liability. The cost basis is what you paid for the home, any closing costs, and non-decorative investments such as getting a new roof. Other expenses such as real estate agent commission and fees can also be included in the cost.

- In the case that your capital losses exceed your capital gains, you can claim a maximum of $3000 (or $1500 if married and filing separately) to lower your income.

- If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase before you sell.

- This is especially popular near year-end, as people start to plan their tax returns for the following spring.

- If you’ve purchased and sold capital assets, such as stocks or cryptocurrencies, then you might owe taxes on the positive difference earned between the sale price and the purchase price.

- Most investors use the first-in, first-out (FIFO) method to calculate the cost basis when acquiring and selling shares in the same company or mutual fund at different times.

Understanding the capital gains tax rate is an important step for most investors. Almost everything you own and use for personal or investment purposes is a capital asset. Examples of capital assets include a home, personal-use items like household furnishings, and stocks or bonds held as investments. When you sell a capital capital gains tax calculator 2020 asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss. Generally, an asset’s basis is its cost to the owner, but if you received the asset as a gift or inheritance, refer to Publication 551, Basis of Assets for information about your basis.

By now, you’ve likely determined whether you have a capital gain — and, if so, whether it’s short-term or long-term. The next step is to understand how that information impacts your tax rate. “Capital assets” are investment or personal assets with any kind of resale value.

A short-term capital gain is the profit on the sale of an investment that you’ve held for a calendar year or less. For example, if you bought a stock on September 15, 2022, and sold that stock on September 3, 2023, any profit from that sale would be considered a short-term capital gain. Short-term capital gains are typically taxed at your federal income tax rate, which is higher than the long-term capital gains tax rate. Short-term capital gains may also be subject to state and local taxes at income rates and not receive potential beneficial treatments like long-term capital gains.

Capital gains taxes are not automatically deducted from your profit. Any capital gains or losses you make in a tax year are usually reported by your brokerage on Form 1099-B. When you sell an asset for a profit, that profit is generally defined as a capital gain. Conversely, selling an asset for a loss is known as a capital loss. Additional information on capital gains and losses is available in Publication 550 and Publication 544. If you sell your main home, refer to Topic no. 701, Topic no. 703 and Publication 523, Selling Your Home.

In general, when interest rates go up, Bond prices typically drop, and vice versa. Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk. All fixed income securities are subject to price change and availability, and yield is subject to change. Bond ratings, if provided, are third party opinions on the overall bond’s credit worthiness at the time the rating is assigned. Ratings are not recommendations to purchase, hold, or sell securities, and they do not address the market value of securities or their suitability for investment purposes.

You owe the tax on capital gains for the year in which you realize the gain. Capital gains taxes are owed on the profits from the sale of most investments if they are held for at least one year. If the investments are held for less than one year, the profits are considered short-term gains and are taxed as ordinary income. We’ll help with all this and more — and it starts with our free Capital Gains Interactive Calculator. In just one screen, this capital gains tax calculator answers burning questions about your stock sales and gives you an estimate of how much your stock sales will be taxed.

You’ll then need to file and pay your Capital Gains Tax bill by 31st January each tax year. Whenever you file your annual federal tax return, you have to complete some additional forms if you had a capital gain or loss last year. You also may get to count the holding period of the person from whom you acquired your stock if you acquired it other than by purchase or other taxable transaction (e.g. if you inherited it).