It happened partially due to improper tax rate settings at the beginning of the year and, also, due improper tax calculations for part-time salary employee. In addition, QBO pulled from nowhere some over payment of taxes from 1st quarter 2021. He helped to submit payroll correction form for last quarter, that supposed to be completed within the definition days sales outstanding.com next days (according to email I received). And he was not able to resolve the issue with the tax over payment for 2021, that suddenly popped up this year at no reason. While it’s not the most comprehensive payroll software because of missing contractor payments and included payroll features, Paylocity remains one of the best payroll services.

Learn To Convert Scanned Documents Into Editable Text With OCR

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. If you use QuickBooks it equipment Desktop Payroll Assisted, contact us if you need to make an adjustment for a previously filed tax form or payment. When you’re managing payroll, it’s important to stay on top of all the details. You should have a separate payroll account from the checking account used for your day-to-day business operations.

How to Make Journal Entries to Adjust QuickBooks Payroll Liability Account?

I too have an issue to where an overpayment was made on the state site so I want to adjust the payment in QB to be the actual payment made not what was due. With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients. When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. Get $30 off your tax filing job today and access an affordable, licensed Tax Professional.

Adjustment for the Employee

- QuickBooks automatically creates default accounts where your liabilities and expenses are recorded.

- It happened partially due to improper tax rate settings at the beginning of the year and, also, due improper tax calculations for part-time salary employee.

- These disparities contribute to the distinct experiences users encounter when managing payroll liabilities in each platform.

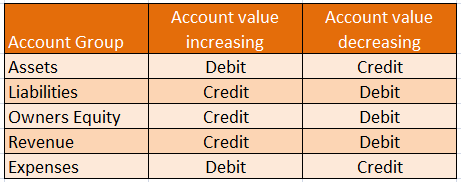

Configuring payroll liabilities in QuickBooks Online entails the setup of tax forms, ensuring accurate financial reporting, and adherence to compliance requirements. In the world of accounting and bookkeeping, managing payroll liabilities is a crucial aspect to ensure accurate financial records. QuickBooks, a widely-used accounting software, offers various tools and features to help businesses adjust, the balance sheet reconcile, and enter payroll liabilities seamlessly. Adjusting payroll liabilities in QuickBooks Online allows you to correct any discrepancies and maintain accurate financial records. Managing and paying payroll liabilities in QuickBooks Desktop involves accurate tax calculations and streamlined payment processing, ensuring comprehensive payroll management and compliance with tax obligations.

Once you have completed all of the necessary information for each employee, you will see a list of employees on your payroll for the year. Review it carefully and make sure all of the pay details are correct. If you have new employees or accidentally left someone out, click the “add an employee” button. Throughout her career, Heather has worked to help hundreds of small business owners in managing many aspects of their business, from bookkeeping to accounting to HR.

Fintechs and Traditional Banks: Navigating the Future of Financial Services

Paycom can be complex for beginners, while Paylocity is easy to use. Also, users praise Paycom’s customer service team for being reliable and helpful while Paylocity customers are not happy about its support. Paycom also has limited integration capability compared to Paylocity. Yes, Paylocity partners with Blue Marble to handle taxes according to employee location and stays on top of tax regulations to help you comply with tax laws. Registered tax experts prepare, review, and file federal, state, and local taxes in all 50 states, Guam, Puerto Rico, and the Virgin Islands. The company also promises to assume any liability that occurs from its error.

In a Payroll centre, you can find the tab that says Pay Liabilities from the given drop-down menu. There will be a connection that says Adjust Payroll Liabilities, if you have clicked on that particular connection, then add your click on the button that says Previous till you get the liability to edit. Following the steps given above will help you fix your problem for good. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

They also loved how easy it was to add new employees and customize Paylocity features to suit each company’s compensation structures. Since Paylocity offers other HR solutions besides payroll, businesses can customize their plans according to their needs. That means you’ll need to contact the sales team for a custom quote. This pricing approach makes Paylocity suitable for any business size, so it doesn’t matter whether you’re a solopreneur, small business, medium-sized business, or enterprise. You’ll get to choose the features you need to handle payroll, and you can always add more as your business grows.

If you’re using QuickBooks Online for your accounting software, a bill will automatically be created for each payroll processed, making reconciling your payroll account a breeze. For more information, check out our guide to reconciling in QuickBooks. Here’s a list of the payroll liability accounts you may need to reconcile. Keep in mind that you can create additional accounts as needed, depending on how specific your accounts need to be.

Regarding tax deadline management, QuickBooks Online‘s automated reminders and filing assistance stand out, whereas QuickBooks Desktop requires more manual tracking. These disparities contribute to the distinct experiences users encounter when managing payroll liabilities in each platform. By utilizing predefined categories and rules, QuickBooks Desktop allows users to set up and manage payroll deductions seamlessly.

Automating transactions reduces manual data entry, minimizing errors and saving time. By addressing these aspects, businesses can effectively manage payroll items and ensure smooth financial operations within QuickBooks Desktop. QuickBooks Desktop aids in tax compliance by generating detailed reports and ensuring that all necessary tax forms and payments are accurately accounted for and submitted on time.